Help with Quick Corporate Minutes

Introduction

Quick

Corporate

Minutes (aka "QuickMinutes") will allow you to enter your

legally required corporate minutes and resolutions. Even if

you are just a one-person operation, the formal requirements

of maintaining complete records of corporate meetings is

essential.

Typically,

you

will have a single set of "organizational" documents that

are produced one time, during the corporate formation

process. If you purchased a "corporate kit" or had a

lawyer draw up your documents, these first meeting minutes

are likely already completed and in your corporate logbook.

If not, you should use QuickMinutes to create them (if you

have purchased the Pro Edition). See

the section on creating One-Time (Organizational) Documents.

For

a very small corporation, you will usually be creating only

Annual Minutes each year to keep your record-keeping

up-to-date. This is a three (3) step process, as outlined

below:

Step

1: Create a Waiver of Notice of Annual Meeting

Since

you are likely a small corporation with a minimum of

directors/shareholders (in many cases, just one!), you can

dispense with notifying everyone that you will be holding a

meeting. BUT, you must have all the directors (or

shareholders as the case may be) sign the consent. You

need not hold an actual in-person meeting, but may instead

specify that any actions were taken by unanimous written

consent. Obviously, if this is not the case you should hold

a meeting with a proper count of directors and/or

shareholders with quorum and vote count results. You can

manually edit the templates to indicate the results of such

a meeting.

Step

2: Create the Resolutions that Pertain to your

Business Activity for the Year

If

you have taken actions in the past year (for instance,

opened a bank account or sign anew lease for equipment) you

should ratify those decisions formally with a corporate

resolution. While it is always better to generate a

resolution before you take action, it is still valid even

after-the-fact. Of course, if you generate five years' worth

of resolution a few days after getting notice of anIRS

audit, they will like consider your corporate status

suspect.

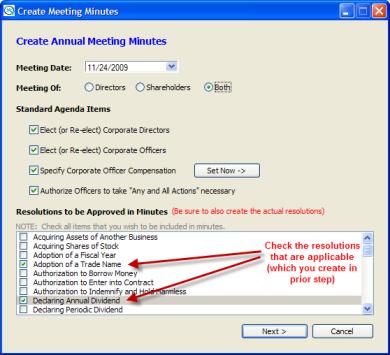

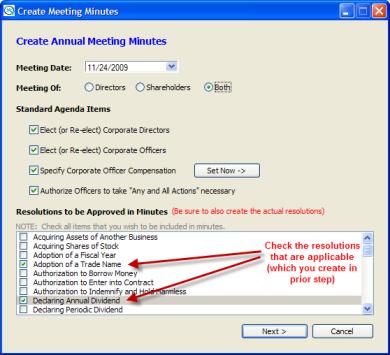

Step

3: Create the Minutes of the Annual Meeting

Once

you have created the applicable resolutions, you need to

formally ratify them in the Annual Meeting. Each resolution

that you created should be mentioned in the minutes.

Typically the annual meeting also sets the Board of

Directors for the upcoming year, as well as officers with

compensation.

IMPORTANT

NOTE: Every state has it's own laws concerning corporate

record-keeping requirements. Although our software conforms

to the laws of most (if not all) states, YOU are ultimately

responsible for conforming to state law and should hire

competent legal counsel if you have unusual or complex

requirements. Our

forms are not a substitute for legal advice and nothing

created or proposed by the software should be construed as

any sort of legal advice or opinion!

You

can get help at any time by pressing the F1 key on the

main screen.

You

can get help at any time by pressing the F1 key on the

main screen.

Installation & Setup

Software Installation

Installing

QuickMinutes

is very easy. A Windows compatible computer with at

least 100mb of RAM memory is required. Simply run the setup

file that you download (or received on the CD-ROM) and

follow the onscreen directions. You can start the program at

any time by double-clicking the QuickMinutes icon on your

desktop screen (or on the start-up menu). When the software

is run for the very first time, a new database will be

created automatically for you. This database will include a

sample company that you can experiment with. When you are

ready to create your first corporate documents, follow the

instructions in the sections below.

Trial Version

Limitations

You

may freely use the Trial Version of QuickMinutes for testing

and evaluation purposes. You can even begin creating your

resolutions and minutes for your corporation. However, the

printing and editing functions are disabled in the TRIAL

version. When it comes time to print (or edit) your minutes

for inclusion in your Corporates Minutes Book, you will have

to purchase a license to use the software.

Software Editions

The

Standard (small business) Edition of the software

allows you to enter and track one corporation. If you have

more than one corporation, we recommend the Pro Edition (up

to 5 companies can be tracked) or for CPAs/Financial

Planners and other serious users we have the CPA Edition (up

to 100 companies can be tracked, with additional paks

of 100 licenses available). The

Pro Edition also allows for customization and creation of

"organizational" or "first-time" documents.

Purchasing the Software

You

may purchase the software by clicking the "Buy" button on

the main screen or by visiting the QuickMinutes website,

at www.QuickCorporateMinutes.com. Remember that each

computer that has the software installed will require

it's own license key.

Entering Your License Key

Once

you have purchased the software, you will receive a License

Code via email. If you did not complete the Internet

activation process, you must enter this number by clicking

on the Help menu, then "Enter License Key".

Once

the license code is accepted, you will receive an

acknowledgement onscreen and thesoftware will allow you to

begin printing and editing reports.

Section 1 - Getting Started

Creating a New Company

Before

you can add new minutes or resolutions, you must first add

your corporate information. To create a new corporate

entity, click the "Company List" button to display the list

of available corporations.

On

the Company List screen that displays, click the "Add New"

button.

The

Corporate Details screen will appear. Complete all the

information at the top that is applicable to your

corporation. If you have not established a bank or attorney,

you may leave those fields blank.

Entering Officers, Directors

and Shareholders

On

the Corporate Details screen, you can add the corporate

officers, directors and shareholders for your corporation

using the “Add New” button.

The

details screen will appear (as shown below) and you simply

enter the officer/director’s name and position. Repeat for

every officer, director and shareholder. Note that if

you are a single person corporation, you would check all the

boxes since you hold all the positions.

First Steps with a New Corporation

If

your corporation is brand new, the very first order of

business is to create the“Organizational” meeting minutes

especially if you created your corporation via a generic

boilerplate language in the Articles of Incorporation. This

needs to be done only once. The items and resolutions will

reflect any initial decisions made by the Board of Directors

and/or Shareholders. This can include the selection of a

bank, setting of corporate officer salaries and other items

necessary for the proper functioning of your corporation.

The

following

actions are prudent at the Organizational Meeting by the

Board of Directors:

Authorize S-Corp status, if applicable

Adopt a form for the minutes of the Board meeting

Adopt By-laws

Adopt shareholder agreements, if any

Elect Directors and Officers

Designate Chairpersons and member of committees

Delegate any duties or Directors that will be handled by

officers or employees of the Corporation

Authorize the application of Federal IRS tax exempt status

Authorize the application of New York State Sales Tax

Authorize the application to United States Postal Service for

Third Class Bulk Mailing Rates

Adopt any DBA ("doing business as") names and company logos,

if necessary

Authorize a corporate bank account

Authorize the payment of organizing expenses and filing fees

Authorize the establishment of a ledger and appropriate

corporate records

Adopt a fiscal year for the corporation, and

Authorize a mileage reimbursement rate at the current year IRS

rates

Section 2 - Creating

Resolutions/Minutes

Creating New Documents

To

create a new resolution or meeting minutes, click the "Add

New" button at the bottom of the Resolution/Minutes

list. On the Add New screen, click the type of

document you wish to create(resolution, notice of waiver of

meeting or meeting minutes. Additionally, you should

indicate if this is an annual meeting or an organizational

(first-time)meeting.

Creating a Waiver of Notice

If

you wish to waive the requirement that directors and/or

shareholders be notified of thetime and place of an annual

meeting, you can simply create a Waiver of Notice and have

all directors/shareholders sign. To create a Waiver of

Notice, selectthe appropriate option and choose the meeting

type (annual, quarterly or organizational).

Creating a Resolution

To

create a new resolution, select the corporate resolution

option and pick on of thetemplates from the dropdown box.

The Data Entry & Review screen will appear, with most of

the fields pre-filled with your data. Edit any entriesthat

you wish to change. Every field must be completed, since the

data will be inserted into your Resolution template.

NOTE:

Data will display exactly as you enter it. In most cases,

the formatting must match the text of the document. For

instance, to enter dollar amounts you must not use the

dollar sign ($), since this will be present in the template.

If you have any doubt, simply click the"Next" button and

review the display. Then close (but don't save) the

Resolution Preview screen and you will have another

opportunity to make changes and re-create the document.

Often it is easier to determine what data needs to be

entered when you view it within the context of the entire

document.

Once

the resolution is created, you may edit the data directly in

the Preview screen:

Creating Minutes

The

primary purpose of the software is to create minutes,

ensuring that the corporateentity is in full legal

compliance and will not be dissolved in a legal challenge.

Officer

Compensation

You

can edit the compensation for your corporate officers

directly in the “Add Minutes”screen by clicking the “Set

Now” button (or you can do it in the Company Details

section).

Section 3 - Managing & Printing

Reports

NOTE:

Printing, exporting and editing of documents is restricted

in the TRIAL version. When you purchase the license key,

your software will become“unlocked” and you will be able to

access all the functions below:

Editing Existing

Documents

To

edit an existing report, simply double-click on it in the

main report list (or use the"View/Edit" button). Note that

all reports are listed in chorographical order, with the

most recent listed first. You can change the order at any

time by clicking on the list headings at the top.

Printing Documents

All

documents

can be printed while the Preview screen is open. Note

that what you see on the screen is howthe document will

print. In some cases, you must manually edit documents to

create smooth flowing page breaks.

Exporting Documents to PDF or MS Word

All

documents

can be exported while the Preview screen is open. Export

formats include Adobe PDF (viewable on nearly every

computer, including Apple/Macs), Microsoft Word (all

versions) and universal rich text format (RTF). A

“Save Dialog” screen will appear and you will need to give

your report a unique name, as the default name is simply the

report title.

Section 4 - Customizing Templates

Customizing Your

Templates

Occasionally,

you

may wish to change the standard text that appears in a

resolution template.This can be done easily, as described

below:

Click

the “Customize Templates” button at the bottom of the main

screen. Select the template you wish to edit or click “Add

New” to create a blank template. Make changes onscreen as

you wish them to appear in the software. Be careful about

deleting/editing the data tags (which are enclosed in double

brackets).

You

can insert new Template Fields by clicking the “Insert

Field” button at top.

Some,

but not all, fields will auto-fill when you generate a

resolution. Others will prompt you to enter the appropriate

data.

Hints for Field Creation

·

Fields should ask for just numeric data (enter the dollar

sign as part of the report text)

·

Make your field names very descriptive or include example

information

·

Try to stick to a consistent naming format so you don’t end

up duplicate fields

·

Do not try to edit the templates outside the built-in editor

(formatting issues may occur)

Standard Fields that Auto-Fill

The

fields listed below (which would appear in double-brackets

like this: [[Meeting Date]]are auto-completed by the

software, but only if you have entered all appropriate data

for the corporation. Fields that require date and times

willuse the current system date/time.

| Date Of Meeting |

|

Corporate

Attorney |

| Date Paid |

|

Corporate Lawyer

|

| Date Cutoff for Shareholders |

|

Street Address |

| Time Of Meeting |

|

City |

| Meeting Time |

|

State |

| Meeting Date |

|

Address,

City, State |

| Meeting Type |

|

Meeting Of |

| Meeting Type UPPERCASE |

|

Meeting Of

UPPERCASE |

| Date of Secretary Signing |

|

Name

of Corporate Secretary |

| Corporation Name |

|

Secretary |

| Legal Name |

|

Corporate

Secretary |

| State of Incorporation |

|

Corporate

President |

| Date of Incorporation |

|

President |

| Tax ID Number (TIN) |

|

Corporate

Vice-President |

| Bank Name |

|

Vice-President |

| Lender

|

|

Corporate

Treasurer |

| Lender Name |

|

Treasurer |

| Accountant Firm |

|

Fiscal

Year START Month/Day |

| Attorney Firm |

|

Fiscal

Year END Month/Day |

| Attorney

|

|

|